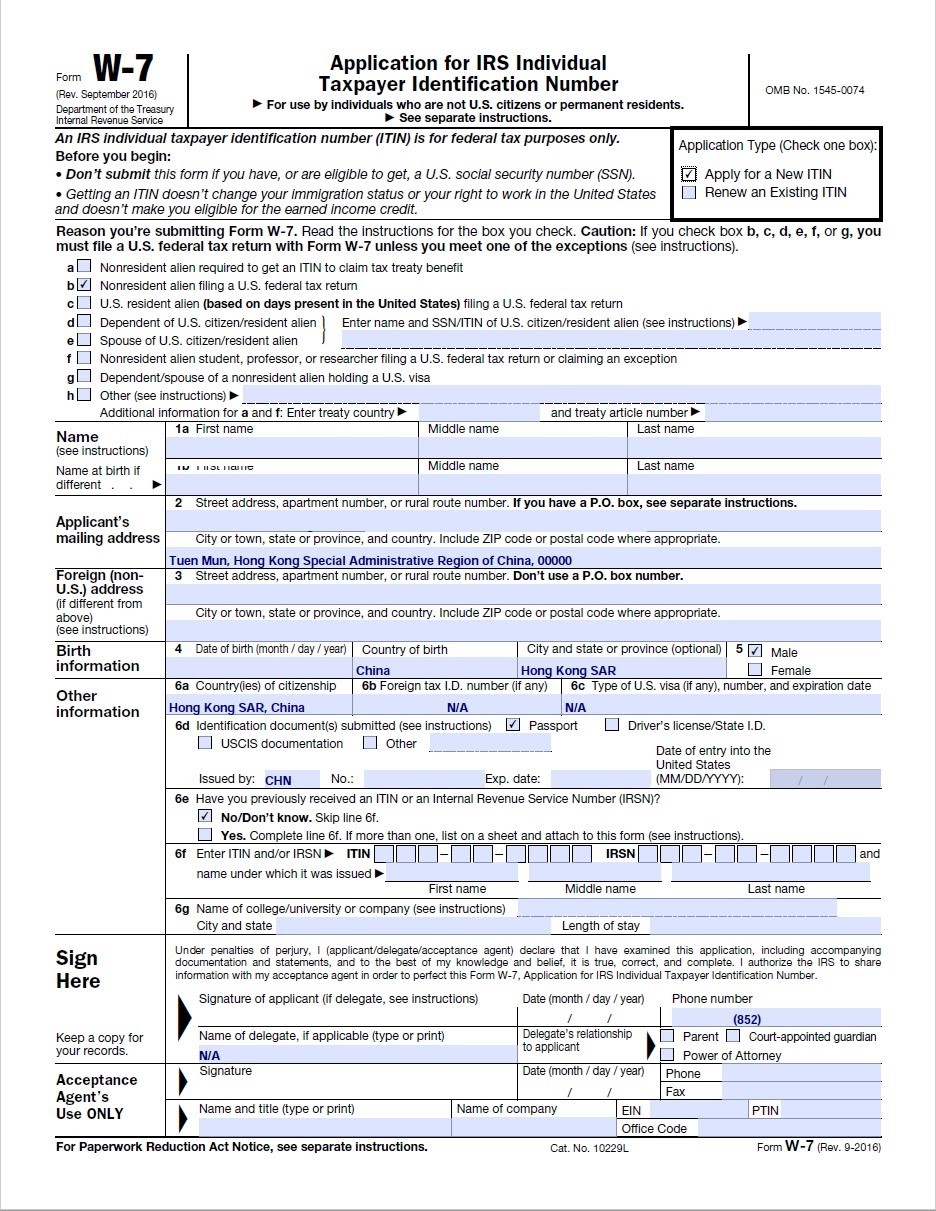

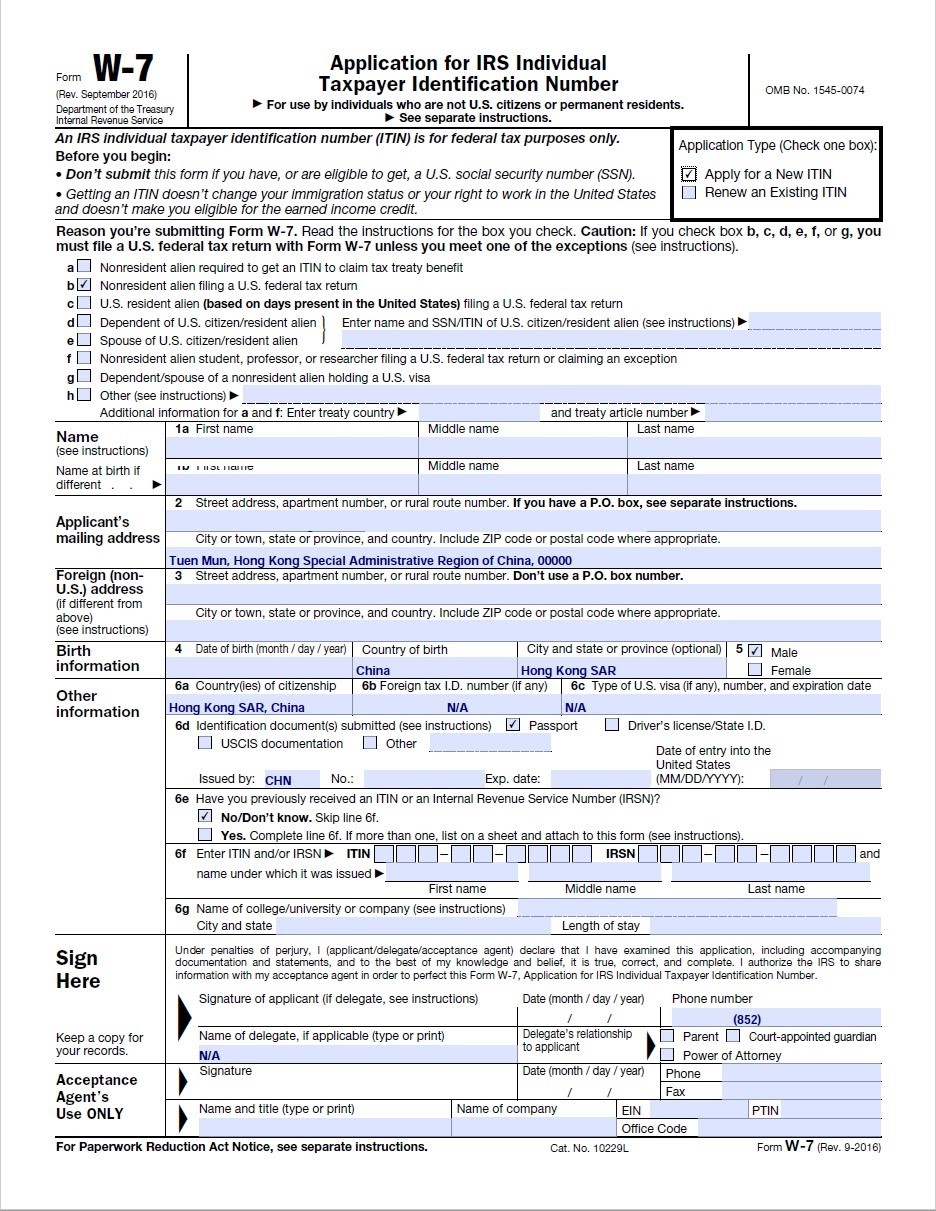

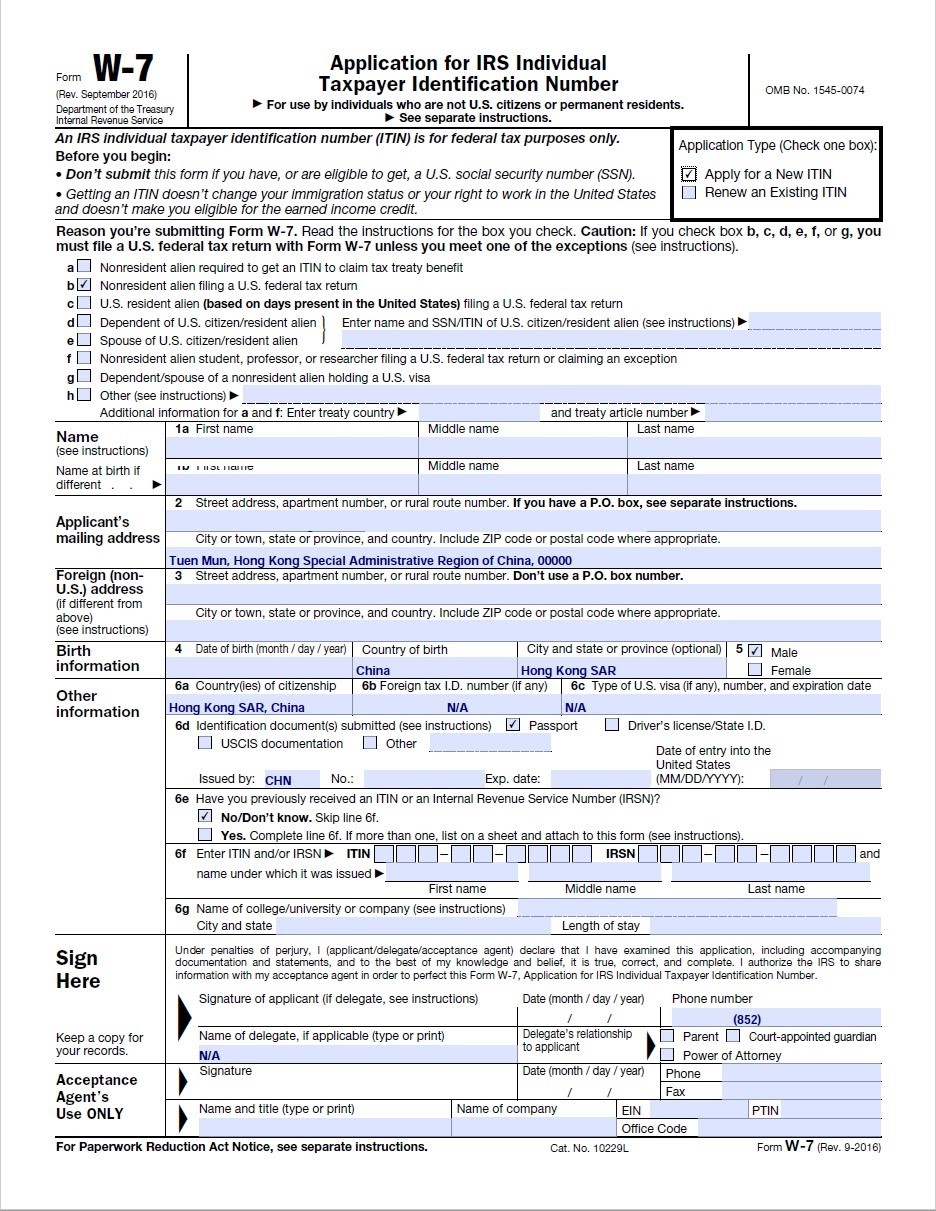

An Individual Taxpayer Identification Number (ITIN)

ITIN Acceptance Agent is a person or organization who is authorized by the IRS to help taxpayers obtain an ITIN. This IRS representative has the power to review ITIN applications and issue an ITIN to any qualified individual who is not eligible for a social security number.

Certified Acceptance Agent (CAA)

Acceptance Agents can help you get an Individual Taxpayer Identification Number (ITIN). Find an IRS-authorized Acceptance Agent by state or country. Section 203 of the Protecting Americans from Tax Hikes Act, enacted on December 18, 2015, included provisions that affect the Individual Taxpayer Identification Number (ITIN) application process.

Section 203 of the Protecting Americans from Tax Hikes Act, enacted on December 18, 2015, included provisions that affect the Individual Taxpayer Identification Number (ITIN) application process. Taxpayers and their representatives should review these changes, which are further explained in these Frequently Asked Questions, before requesting an ITIN.